What Is Amortization And How May It Affect My Auto Loan?

Intuit doesn’t have any duty for updating or revising any info offered herein. Accordingly, the data provided shouldn’t be relied upon as an different alternative to unbiased analysis. Intuit does not warrant that the material contained herein will proceed to be accurate nor that it’s utterly freed from errors when printed.

Understanding Amortization: Which Means, Calculation, And Schedules

Amortization is a basic monetary concept that entails the gradual compensation of a mortgage or the systematic reduction of the value of an intangible asset over time. Understanding how amortization works is essential for both borrowers and accountants because it impacts mortgage repayment schedules and monetary statements. Amortization is a monetary concept that enables an asset or a long-term liability value’s gradual allocation or compensation over a selected interval. This method helps in matching the bills with the revenue or advantages generated by an asset or legal responsibility over time with accuracy.

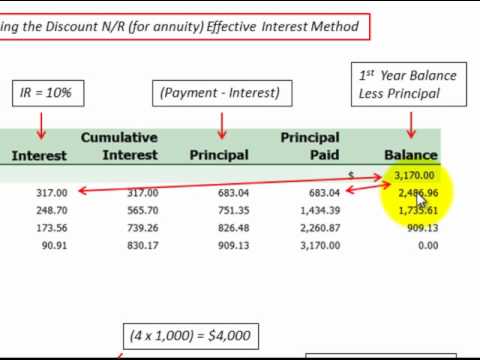

Moreover, amortization in accounting provides a more accurate representation of an organization’s financial efficiency. Loan amortization determines the minimal month-to-month cost, but an amortized mortgage does not preclude the borrower from making extra payments. Any quantity paid past the minimum month-to-month debt service typically goes toward paying down the mortgage principal. This helps the borrower save on total curiosity over the life of the mortgage. Lenders use amortization tables to calculate month-to-month payments and summarize mortgage compensation particulars for borrowers.

Moreover, it’s a valuable software for budgeting, forecasting, and allocating future bills. The amortization table is constructed round a $15,000 auto mortgage with a 6% rate of interest and amortized over a interval of two years. Absent any further payments, the borrower can pay a complete of $955.42 in curiosity over the lifetime of the mortgage. A borrower with an unamortized loan solely has to make curiosity payments in the course of the loan interval. In some instances the borrower should then make a ultimate balloon payment for the total mortgage principal at the end of the loan time period. For this cause, monthly funds are often lower; however, balloon funds can be tough to pay all at once, so it’s essential to plan forward and save for them.

How Is Amortization Calculated For A Loan?

The amortization of an asset should solely start when the asset is introduced into precise use, and never earlier than, even if the requisite intangible asset has been acquired. For example, if an asset has a straight-line price of 10%, the double declining rate could be 20%. This greater fee leads to larger deductions early on, providing vital tax advantages and aligning expense recognition with the asset’s utilization pattern. This method is simple and provides a constant expense recognition, making it straightforward to finances and forecast monetary obligations. Monetary analysis is a strategy of evaluating a company’s financial performance and determining its strengths and weaknesses.

Negative amortization occurs when the borrower’s cost is less than the curiosity charged on the mortgage. As a result, the unpaid interest is added to the principal stability, which will increase the loan amount. The amortization schedule reveals how a lot of each payment goes in the path of the principal and the way much goes in path of curiosity.

Quickonomics offers free entry to education on economic matters to everyone all over the world. Our mission is to empower people to make better selections for their personal success and the benefit of society. For extra info on how to claim intangibles for tax purposes, you probably can check with the Government of Canada web site. For instance, imagine your business has purchased a patent for $10,000 which has a useful life of five and no salvage worth. Depreciation would have a credit score placed within the contra asset accrued depreciation.

- Furthermore, amortization enables your small business to own extra revenue and assets on the steadiness sheet.

- Depreciation entries all the time post to amassed depreciation, a contra account that reduces the carrying worth of capital property.

- Mortgage amortization is the method of scheduling out a fixed-rate mortgage into equal payments.

- A portion of each installment covers interest and the remaining portion goes toward the mortgage principal.

- Dreamzone divided the purchase value by the useful life to amortize the patent’s cost.

In these instances, there might be a balloon cost due (a giant lump sum payment). A partially amortizing mortgage could be A nightmare for homeowners or firms which may be unprepared. One of the trickiest elements of using this accounting method for a business’s belongings is the estimation of the intangible’s service life. Business operators must weigh out the financial value to the company, including the e-book value, salvage worth, and the helpful life of the intangible asset. Revolving debt is a sort of loan where the borrower has access to a line of credit that can be utilized and paid again repeatedly. The borrower is just required to make minimal payments each month, which can lead to adverse amortization if the interest charged on the loan is larger than the minimum fee.

From the tax yr 2022, R&D expenditures can no longer be expensed in the first yr https://www.simple-accounting.org/ of service in the United States. Instead, these expenses should be amortized over 5 years for domestic research and 15 years for international study. The research and improvement (R&D) Tax Breaks are a set of tax incentives that helps attract corporations with excessive research expenditures to the United States.

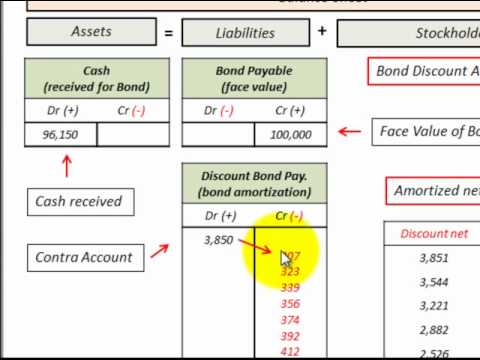

Decrease rates of interest can end result in decrease monthly payments and fewer curiosity paid over time. Nevertheless, this structure leaves a good portion of the principal due at the end of the time period. Understanding amortization is crucial for accurate financial reporting and might considerably impression a business’s tax obligations. Amortization bills lower the long-term asset worth on the stability sheet and are acknowledged as expenses within the income assertion.

Like mortgages and car loans, personal loans use amortization to repay the mortgage over time. Mortgage amortization can be used to calculate the payments on other types of loans, similar to automotive loans or private loans. This implies that this company would report an expense of $10,000 yearly. Dreamzone Ltd will report this expense on the income statement, which will reduce the company’s web earnings.